Introduction:

Transition to Retirement (TTR) strategy has gained popularity among individuals seeking financial flexibility as they approach retirement. However, its suitability varies depending on various factors. In this comprehensive guide, we delve into the intricacies of TTR, exploring its benefits, considerations, and whether it’s the right fit for everyone.

Transition to Retirement (TTR) Strategy:

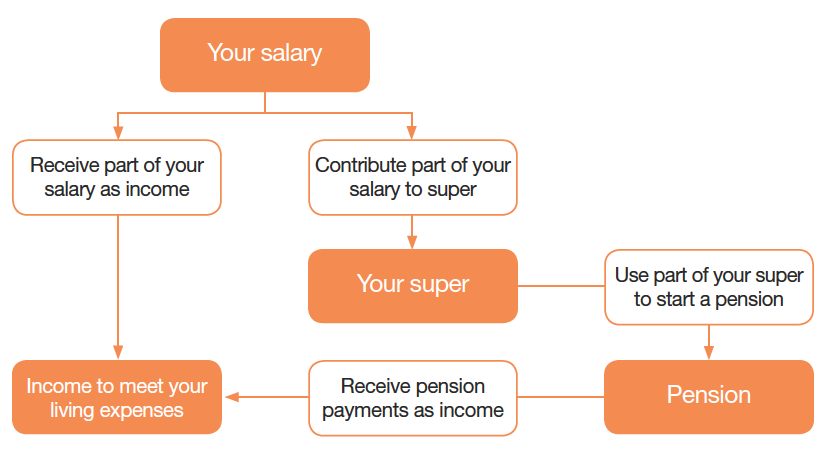

Transition to Retirement (TTR) is a financial planning strategy that allows individuals aged over 55 (preservation age) to access a portion of their superannuation while continuing to work. This strategy involves drawing a regular income from superannuation while simultaneously working part-time or reducing work hours.

Is TTR Suitable for Everyone?

1. Financial Considerations:

-

Superannuation Balance: Individuals with substantial superannuation savings may find TTR beneficial as it allows for tax-effective income supplementation.

-

Tax Implications: TTR withdrawals are generally taxed at concessional rates, making it attractive for tax planning purposes.

-

Income Needs: TTR is suitable for those who wish to supplement their income during the transition phase to retirement without entirely ceasing work.

2. Age and Preservation Age:

-

TTR is specifically designed for individuals who have reached their preservation age, which varies depending on birthdate.

-

Younger individuals may not find TTR suitable as they might prefer to continue working full-time without accessing their superannuation.

3. Employment Status and Work Arrangement:

-

TTR is ideal for individuals who wish to reduce their working hours gradually.

-

Those planning to retire completely in the near future may not benefit significantly from TTR.

4. Risk Tolerance and Investment Strategy:

-

Individuals with a conservative risk profile may prefer TTR as it provides a steady income stream with reduced reliance on work.

-

However, those with a higher risk tolerance may opt for alternative investment strategies.

5. Health and Lifestyle Considerations:

-

TTR allows individuals to maintain a work-life balance, which can be particularly beneficial for those with health concerns or family commitments.

-

However, individuals in demanding professions or with extensive career commitments may find it challenging to balance work and TTR.

Transition to Retirement (TTR) strategy offers a flexible approach to retirement planning, allowing individuals to supplement their income while transitioning from full-time work to retirement. While TTR can be advantageous for many, its suitability depends on various factors such as financial circumstances, age, employment status, risk tolerance, and lifestyle preferences.

For personalized advice and assistance in implementing a TTR strategy tailored to your specific needs and circumstances, consider consulting a qualified financial planner. James Hayes Finance, located in Caringbah, specializes in providing expert financial advice, including transition to retirement strategy. Contact James Hayes Finance today to embark on your journey towards a secure and fulfilling retirement.

Looking for professional financial advice Caringbah? Turn to James Hayes Finance for expert guidance on transition to retirement strategies and comprehensive financial planning. Contact us today to schedule a consultation and secure your financial future with confidence.

Frequently Asked Questions (FAQs)

1. Who is eligible for a Transition to Retirement (TTR) strategy?

-

Individuals aged over their preservation age (typically between 55 and 60, depending on birthdate) who are still working are generally eligible for TTR.

2. How does a TTR strategy affect my superannuation balance?

-

TTR involves drawing a regular income from your superannuation, which can impact your super balance over time. However, it can also provide tax advantages and flexibility in managing your retirement income.

3. Can I access my superannuation tax-free through TTR?

-

TTR withdrawals are generally taxed at concessional rates, which can be advantageous compared to regular income tax rates. However, specific tax implications depend on individual circumstances and should be discussed with a financial advisor.

4. How much income can I draw through a TTR strategy?

-

The amount of income you can draw through TTR is subject to regulatory limits set by the government. These limits are calculated based on your age and superannuation balance. A financial planner can help you determine the appropriate income level for your TTR strategy.

5. Can I continue working full-time while using a TTR strategy?

-

While TTR allows you to access a portion of your superannuation while still working, it is primarily designed for individuals who wish to reduce their working hours gradually. Continuing to work full-time may limit the benefits of a TTR strategy.

6. What investment options are available within a TTR strategy?

-

TTR allows individuals to choose from a range of investment options available within their superannuation fund. These options may include diversified portfolios, managed funds, shares, and cash investments. Your choice of investments should align with your risk tolerance and retirement goals.

7. How do I know if a TTR strategy is suitable for me?

-

The suitability of a TTR strategy depends on various factors, including your financial situation, age, employment status, risk tolerance, and lifestyle preferences. Consulting with a qualified financial planner can help you assess whether TTR aligns with your retirement goals and objectives.

8. Can I stop or modify my TTR strategy once it’s in place?

-

TTR strategies can be flexible and adjusted according to your changing circumstances. You can choose to stop or modify your TTR arrangement at any time, subject to the terms and conditions of your superannuation fund and relevant regulations.

9. What are the risks associated with a TTR strategy?

-

Risks associated with TTR include fluctuations in investment markets, changes in taxation laws, and potential impacts on retirement savings. It’s essential to consider these risks and develop a comprehensive retirement plan that addresses your financial objectives and risk tolerance.

10. How can a financial planner assist me with implementing a TTR strategy?

-

A qualified financial planner can provide personalized advice and assistance in designing and implementing a TTR strategy tailored to your specific needs and circumstances. They can help you navigate regulatory requirements, optimize tax benefits, and make informed decisions to achieve your retirement goals.